How Good Is Your Commercial Insurance for Mold?

8/3/2020 (Permalink)

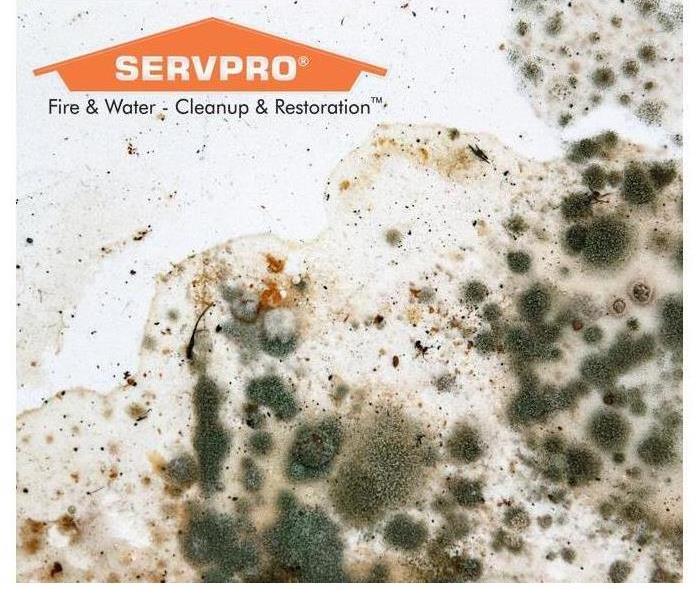

As a property manager or a business owner in Casselberry, FL, there's no shortage of things to keep you awake at night. You might wonder what forms you haven't filled out, or what the next surprise will be. When it comes to your commercial insurance, you might wonder if there is a scenario out there that you need more robust coverage. What about an outbreak of mold in the dark and damp corners of your business? Could that be a problem? Well, just like a lot of things in life, it all depends. In general, though, so long as you have not been woefully, negligent, your commercial policy provides some basic protections against mold damage.

The Basics of Commercial Insurance for Mold

Insurances policies are complicated documents, so it is always best to go over your policy with your agent for final clarification. In general mold insurance covers these instances for a commercial property:

- Most policies provide for a limited fungus coverage

- The coverage pays for loss or damage caused by fungus or dry rot and bacteria

- The cause of the mold damage must be from a specified cause such as water damage or leaking fire-fighting equipment

Once the mold has been discovered, action must be taken immediately by your company. Failure to respond prudently with mold mitigation measures can result in a forfeiture of your mold insurance coverage.

The Basics of Mold Cleanup

Once mold is found in your building, it's smart to deal with a professional mold remediation company in Casselberry, FL. The experts will come to the scene quickly and begin the process of mold containment and a full cleanup. The mitigation company will help you work with the commercial insurance agent by providing a detailed list of services and repairs. In general, mold policies limit coverage to a specified dollar amount. This could be for multiple incidents, but the total payout would not exceed $15,000 a year.

24/7 Emergency Service

24/7 Emergency Service